Check the background of our Investment Professionals on FINRA's BrokerCheck »

My Articles, Videos, & More

I’ve put together a series of articles, videos, and downloadables on financial topics and wealth management to help you feel more confident about your money and retiring.

Whether you're planning for or nearing retirement, thinking about investments, or just looking to make smarter financial decisions, these articles are meant to give you clear and useful insights. I hope you find them helpful as you navigate your financial journey. And please reach out as you go through these and take the next step. ~Tom (636) 777-7011 or tomgilliam@carillongroup.com

Articles

%20Pic%20Page%201.png)

Social Security Trust Fund Projected to be Depleted by 2033

Social Security Could Be Cut by 23% by 2033

The clock is ticking. Fewer workers, more retirees, and no fix in sight. If you're nearing retirement, now’s the time to plan. Read more to see what you can do today.

The 5 Primary Risks in Retirement Income Planning

When planning for retirement and you fall into my so-called “Retirement Red Zone” (the 5 years before and 5 years after your retirement start date), there are five areas retirees need to think about and protect their assets against.

Videos

Should I consider an IRA Roth Conversion?

Wondering what it means to convert your pre-tax Traditional IRA into a Roth IRA? In this video, we’ll explain the key differences between Traditional and Roth IRAs and help you decide if a Roth conversion fits your financial goals.

If managing taxes better and boosting your retirement strategy sounds appealing, this could be a game-changer. Watch now to learn more!

What type of risks are there in Retirement Income Planning?

Understanding the "Five Primary Risks" in Income Planning is essential for crafting a robust income strategy that will last. In my video, I’ll touch on each risk. Planning for retirement isn't just about saving and withdrawing money, it's about ensuring a steady INCOME throughout retirement while navigating potential pitfalls!"

Do I need Disability Insurance

as a Physician in Residency or Fellowship?

What do I need to know before I enter practice?

Your focus is on building your career, but have you considered protecting your future income? In this video, you'll learn why disability insurance is essential for physicians in training and how securing coverage before private practice can unlock valuable discounts and stronger benefits. Watch now to get informed and request your personalized, no-obligation proposal.

Downloadables

What is the 555 Retirement Plan and why do I need it?

Planning for retirement can feel overwhelming, but it doesn’t have to be.

Explore the “555 Retirement Plan Check-In” to map your path starting 5 years before retirement, during the first 5 years, and beyond so you can plan, protect, and enjoy every stage. Have questions? 636-777-7011

Do you feel Confident in your Retirement Readiness?

Don’t Pause Your Future.

Ask yourself:

• Do I know my numbers?

• Have I reviewed all of my sources?

• Have I reviewed my Social Security options, statement, or other income sources?

• Am I diversified well enough?

Now is a good time to go over all of these items and to remind yourself of how far you've come. Let's talk about what you can do today to feel more financially confident in your future. The time is now.

Actively job searching, transitioning, or starting

to plan?

Having a solid financial strategy is key to navigating this time with assurance.

Here is a checklist to help you stay on track. Feel free to share with others and please reach out if you need to ask questions or just want to talk it through.

FREE Financial Preparedness Consultation - We've helped hundreds of clients manage their finances during critical life transitions. In our complimentary session, we’ll take a look at your current financial situation and talk about ideas and strategies that make the most sense for you and your financial future.

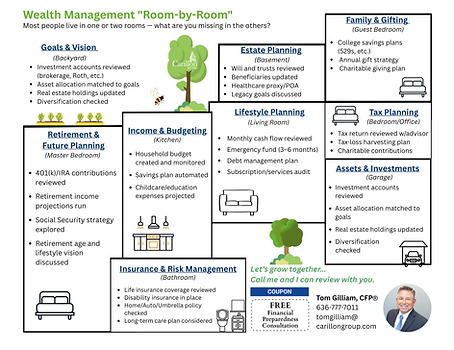

What if your finances were organized like your home?

Your Kitchen = Budgeting & Income Flow

Your Living Room = Lifestyle & Spending

Your Bedroom = Retirement Comfort & Planning

Your Basement = Estate & Legacy Planning

And yes, even the Bathroom = Insurance & Risk Management

We created a Room-by-Room Wealth Checklist to help you rethink financial planning in a way that feels practical, visual, and personal. We know cleaning clears the mind and organizing creates systems and flow. Better your life.